Cottage, Micro, Small & Medium Enterprises (CMSMEs) are acknowledged...

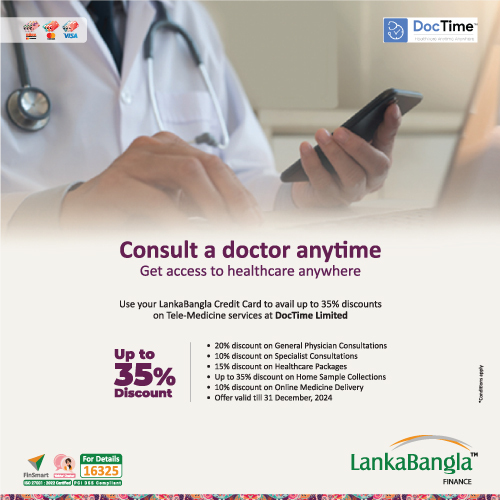

LankaBangla offering a wide variety of retail financial services...

LankaBangla Finance PLC. is a place from where you can find...

Shikha is a platform to support and motivate women entrepreneurship...

Cottage, Micro, Small & Medium Enterprises (CMSMEs) are acknowledged...

LankaBangla offering a wide variety of retail financial services...

LankaBangla Finance PLC. is a place from where you can find...

Shikha is a platform to support and motivate women entrepreneurship...

Calculate your loan EMI

Checkout our Credit Rating

Explore press release & videos

Explore our latest news & notice

Explore our latest articles

We’ll help you work it out.